In times of economic turmoil, it’s tempting to do something — anything — to stop the financial pain. Often, however, the decisions we make in lean times do not serve our long-term financial interests.

Many experts believe this response is rooted in the psychological phenomenon known as recency — the tendency to value recent experiences more than past ones. “We think that whatever has been happening recently will continue to happen indefinitely,” says Liz Weston, author of Easy Money: How to Simplify Your Finances and Get What You Want Out of Life (FT Press, 2008). In short, we start to view the squeeze on our wallets and the downturn in the markets as permanent problems, and we begin to panic. “That leads people to do a lot of foolish things,” she says.

We asked Weston and other top personal-finance experts to describe some common money mistakes people make when the economy is shaky — and show us how we can avoid them.

Mistake NO. 1: Curtailing retirement investments.

Your rationale: My 401(k) balance is tanking. It seems like putting more funds into it now is just throwing my money away.

The risk: Stop buying now, and you’ll miss out on all the bargains. Yes, you want to buy selectively, but by continuing to invest while the markets are depressed, you’ll net big gains when the market (inevitably) bounces back, says Chris Farrell, economics editor for American Public Media’s Marketplace Money and author of Right on the Money!: Taking Control of Your Personal Finances (Villard, 2000).

Better approach: The current crisis has people worried, but many respected experts (including self-made billionaire investor, Warren Buffett) are still investing. If you are investing for the long-haul and can stomach the interim fluctuations, say many pros, stick with it. The dynamism and resilience of the American market will ultimately reward your patience. “Stay the course and keep contributing,” says Weston. “Over time, the stock market will do better than any other investment.”

Whether or not it’s wise to pursue a dollar-cost-averaging approach is a matter of some debate. But most experts agree that continuing to invest retirement funds in some way is a good idea. Do some research to determine where you want your current and future allocations to go. For some insight, visit http://www.fool.com/retirement.htm or www.tiaa-cref.org/services/retirement-planning-advice/.

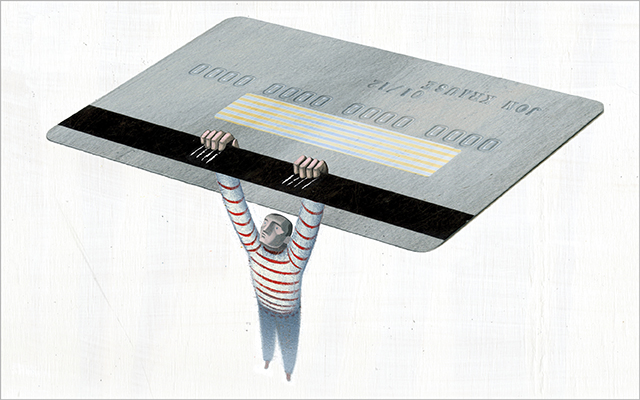

Mistake NO. 2: Relying on credit.

Your rationale: I’m buying what I need — and I’ll pay off the interest when the economy turns around. Besides, I get rewards for every dollar I spend.

The risk: Using plastic to pay for what you can’t afford — even for a month or two — sets you up for major trouble. “High interest rates will haunt you,” says Kimberly Lankford, author of Rescue Your Financial Life: 11 Things You Can Do Now to Get Back on Track (McGraw-Hill, 2004). Plus, credit-card companies are changing their terms and credit limits like crazy right now, so assuming your current terms will hold is a mistake. And if you have a $1,000 balance at 20 percent interest and pay only the minimum monthly payment (let’s say it’s 4 percent of the balance, or $40 dollars a month), it will take you seven years and seven months to pay off and cost you an additional $611.82.

The other problem: “If you’re buying on credit, you’re going to spend more,” says Galia Gichon, author of My Money Matters: Tools to Build Peace of Mind & Long-Term Wealth (Consortium Books, 2008). “And you’ll never make that up in the meager rewards you get as a result.”

Better approach: Take a hard look at your budget and ax low-value or unnecessary expenses, particularly those that aren’t sustaining you or bringing you deep satisfaction. Things not to ax: Preventive-care medical and dental appointments, necessary house maintenance, routine car care, or anything necessary to support your basic well-being. An unexpected medical or dental emergency, or a major home or car repair, can put even more pressure on your pocketbook.

Mistake NO. 3: Cutting back on home, auto and medical insurance.

Your rationale: Those premiums cost a lot every month, and they don’t really do much for me day to day.

The risk: Lowering liability coverage on your car or home insurance will leave you exposed in the event of an accident, fire or natural disaster. “It’s not a good place to save money,” says Weston. “One big accident can bankrupt you.” The same is true of health insurance, where a single visit to the emergency room can cost thousands.

Better approach: Consider raising your deductible. “By increasing your [home or auto] deductible to $1,000 or more, you can cut your rate by 15 to 25 percent,” says Lankford. “You’re still covered [for a catastrophe], but that savings can make a big difference.” To get more from your medical insurance, consider enrolling in a pre-tax medical spending plan if your employer offers one. Also, many companies and insurance carriers will lower your monthly premiums if you participate in wellness programs or commit to regular trips to the gym.

Mistake NO. 4: Failure to automate.

Your rationale: I like the flexibility of deciding when I’m going to pay my bills. The occasional late fee isn’t going to break me. And if I automate deposits to a savings or investment account, I might run short on money for daily necessities.

The risk: Late fees are not just annoying; they are good money down the drain. Plus, each missed payment damages your credit score. As a result, your credit-card interest rates are likely to spike, your credit limits could shrink, and you may end up paying more for car insurance and home and auto loans.

Failing to automate your savings deposits reduces the likelihood of their happening at all, says Gichon. And let’s face it: Once money is in your checking account, it’s as good as spent.

Better approach: Schedule everything. Today, automation is much safer than it was in years past. Plus, the amounts and dates you automate aren’t set in stone. You can adjust your savings amounts as your needs shift, or rearrange the deposit dates if your payday moves. You can always skip an automated deposit if you have to. And in the event you run out of funds, most banks won’t create overdrafts to complete these sorts of deposit transactions (but practices vary, so ask to be sure).

As you develop sound financial habits, don’t let them slip when the economy starts humming again, says Farrell. Instead, keep sharpening your budget and planning skills over time. “I can tell you two things: The first is that we’re going to come out of this downturn. The second is that, eventually, we’re going to have another one. You can’t be surprised by it — you have to just build it into your planning.” After all, the cost of bad financial decisions is high — and the value of good ones is priceless.

Bright Ideas for a Bad Economy

Want to make the right money moves in a downturn? Here are some smart ideas for staying solvent:

Pay for everything in cash. Paying in cash is an effective way to stick to a budget. Estimate how much money you need for one week’s worth of expenses and withdraw that amount in cash at the beginning of the week. Then don’t allow yourself to go back for more cash until the next weekly withdrawal. This method keeps you on budget (when the cash is gone, so is your ability to spend more) and makes every purchase more real: That expensive vase might not seem as appealing or practical as you peel off $20 bills to pay for it.

Build a cash cushion. Most experts recommend saving three to six months’ worth of living expenses in case of job loss or other emergencies. That may sound daunting, but by starting small and automating your deposits, your savings-account balance will rise slowly but surely. And just knowing you have a small amount set aside in savings can help quell feelings of financial anxiety.

Negotiate, negotiate, negotiate. If you’re planning to make a big-ticket purchase in a slow economy, be sure to negotiate. Retail outlets feel the full and immediate impact of an economic downturn, and often they are willing to negotiate a better price to make a sale.

This Post Has 0 Comments