It’s easy to go on autopilot when it comes to managing money. You might toss bills into a drawer, shop mindlessly online, or pay for dinner with a credit card when your bank balance is too low. Maybe you leave the finances to your partner, then feel clueless about how much money you really have. Or perhaps you have a good income but refuse to buy a decent winter coat or donate to a single charity because you fear going broke.

These behaviors are clearly self-defeating, yet there are legitimate reasons we act this way.

One is confusion. “It’s impossible to understand something that we never talk about,” says financial educator Kate Northrup, author of Money: A Love Story. “There’s so much secrecy about money from the very beginning of our lives. Most children have no idea how much money their parents make. We’re kept in the dark and not taught how to handle our finances.”

Financial illiteracy isn’t the only reason we behave unconsciously. Our consumer culture is characterized by scarcity mentality, which is so frightening it can shut down rational thought. This view holds that there’s not enough for everyone, and more is always better. It encourages us to compete rather than cooperate with others. And when we’re motivated by scarcity, and its attendant emotions of fear and shame, we can quickly develop habits of avoidance.

Yet it is possible to move from a scarcity mindset to a more conscious, calm, and generous one. The key to this shift involves moving from a mindset of “you or me” to one of “you and me,” explains Lynne Twist, founder of the Soul of Money Institute. When we expand our thinking to include the common good as well as our own well-being, we experience the true meaning of prosperity: the feeling that we finally have enough.

The following three steps can help us move away from a scarcity mentality and cultivate more satisfying financial lives.

1. Learn What “Enough” Feels Like

“Some of us have a scarcity mentality because we experienced scarcity,” says Brent Kessel, author of It’s Not About the Money and CEO of Abacus Wealth Partners. “We saw our parents having scarcity, or we ourselves went through it. It’s a terrifying feeling to not have enough money and be worried: Will I be able to eat? Will I be kicked out of my apartment?”

But, he notes, there’s a difference between genuine scarcity and the scarcity mentality that fuels consumer culture. Scarcity mentality is a zero-sum game. It presumes there are only so many slices of pie to go around, and argues that we should grab as many pieces as possible. If that means someone else gets no pie, then so be it.

This mode of thinking can affect virtually all aspects of our lives, and it has almost nothing to do with how much money we have. People with modest means can feel perfectly satisfied, while those with abundant wealth might behave as if they were living paycheck to paycheck.

In her book The Soul of Money: Transforming Your Relationship With Money and Life, Twist describes scarcity mentality as a “chronic sense of inadequacy” that shapes our sense of self. Scarcity “becomes the lens through which we experience life,” she writes, and it can lead to a “self-fulfilling prophecy of inadequacy, lack, and dissatisfaction.”

This mindset, says Northrup, is also at the heart of jealousy — and not simply of material things. Say your friend lands a great job, and instead of feeling happy for her, you feel terrible. It’s almost as if something has been taken from you. But Northrup believes jealousy can be a key to insight if we don’t get caught up in the illusion of being deprived.

“Comparison is normal,” she explains, “but when you start thinking that if somebody else has something, then you can’t have it, it’s time to examine those feelings.”

If you pull back the curtain of jealousy in this instance, you might discover that you’d like to switch jobs yourself. Instead of believing your friend got the last decent job, you might choose to see her success as proof that other cool opportunities are out there — that there’s enough to go around.

“A lot of people think the opposite of scarcity is abundance, like living the ‘lifestyle of the rich and famous,’” Kessel explains. “But the opposite of scarcity is sufficiency, which is just enough.”

The perspective of lack is deep and cultural, so shifting it usually requires concrete, physical steps. Kessel offers these exercises:

• Imagine your preferred financial future and journal about it. Maybe you want to be free of worrying about money. Or you’d like to be able to afford dinner out a few times a month. Perhaps you’d prefer to work only a certain number of hours per week and have time to visit museums. Define how you want to feel about your financial life and write it down.

• Look for examples of sufficiency. Our brains seek to confirm our beliefs; it’s called confirmation bias. And when we’re caught in a scarcity mindset, Kessel says, we tend to look for proof. We might think, Look, there’s another person who’s struggling. See, there isn’t enough money to go around!

Try seeking examples of sufficiency instead. Think about that friend who lives comfortably on a smaller paycheck than yours and enjoys more free time. Clean out your closet so you’re left only with clothes you love, and donate the rest. Buy a friend coffee instead of paying separately. These small gestures can help reorient you to sufficiency instead of scarcity — and create the potential for greater generosity.

• Do something in the next 24 hours to cultivate the feeling of sufficiency and move you toward the future you want. Each person’s needs will be different, but whatever you choose to do, make it concrete. You might start by giving something away. Kessel stresses the importance of practicing generosity to combat scarcity thinking.

“I’m a big believer in generosity as a subliminal message to ourselves that there is enough. Give to the level that makes the pleasure-seeking part of you — and even the security-seeking part of you — a little bit quaky,” he says.

“If you make $300,000 a year and you’re giving away $2,000 a year, that’s kind of just a rounding error — you don’t really notice it. That’s not going to change your mindset.”

To experience sufficiency in a deeper way, he suggests giving an amount that would force you to say, “That’s a little bit hard to write that size check, but I do want to do it, and I believe in the cause, and I’m fired up about the impact that my gift is going to have.”

Being generous can make us feel rich, like we have enough to spare — which is the ultimate antidote to the scarcity mindset.

2. Don’t Believe the Consumer Hype

Every day we’re pressured from all directions to buy and consume more than we need. But we don’t have to give in — especially when we stay conscious of the messages we’re getting.

“Part of being human is having times when you feel kind of hollow inside, kind of empty, and that’s natural,” Kessel says. “But what our money culture has trained us to believe is that if you’re feeling kind of empty, something’s wrong, and something’s wrong with you, and there’s a product or a service out there to take that feeling away.”

That belief system is driven by brain chemistry and ingrained by marketing. We get a rush when we buy something we want; it activates the brain’s reward center and triggers a rush of feel-good dopamine. But as the rush recedes, regret and remorse often roll in, which lead us to make another purchase to avoid discomfort. Experts call this the “hedonic treadmill.”

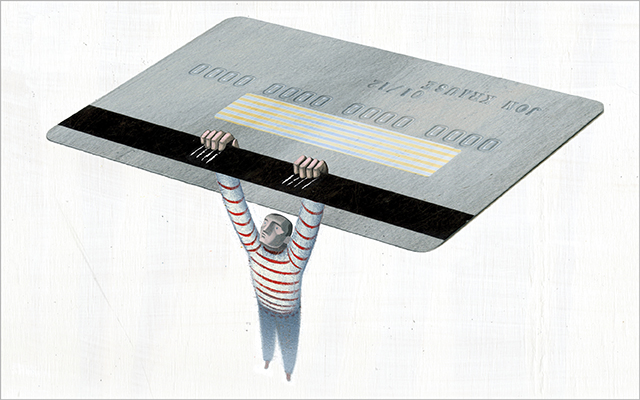

Using credit cards instead of cash also triggers unconscious money behaviors, explains financial educator Ruth Hayden, author of Your Money Life. As we become an ever-more cashless society, we grow less aware of our spending habits and their consequences.

“People spend more when they’re using something that’s not cash,” she says. “When they’re using a debit card or credit card, they spend somewhere between 30 and 35 percent more, and it can go as high as 42 percent if there’s a reward involved, like miles or cash back or a discount at the store.”

Hayden thinks we need to change the way we interact with money itself, and she recommends these tactics:

• Start saving for retirement now. If you work for a company that matches a certain level of savings, put away at least that much. Acknowledge that this allows you to take control of your money.

• Tuck away a set amount from each paycheck. Even $20 is enough, says Hayden. Keep this money available so you are consciously choosing not to spend it. This allows you to experience the satisfaction of saving.

• Stick to cash instead of plastic whenever possible. “Working with cash on a daily basis keeps people very conscious about money,” Hayden says. “It is the height of mindfulness and money.”

If you’re really dying to buy something, Kessel suggests writing down what you think it will do for you. For example: If I go away this weekend and stay in that great hotel on the beach, I’ll feel super-relaxed with the sun on my skin and I’ll come back rejuvenated and ready to have a productive month.

Then, if you make the purchase, check in on the reality afterward. How did it compare with your inner advertising campaign? This is a deeper way of tracking your spending: It’s qualitative, not just quantitative.

“Then you can start to learn from these spending audits and make some better choices,” Kessel says. “What most of our clients realize is that experiences are much more important than material possessions.”

Purchases that involve other people also tend to offer more lasting satisfaction, so long as they’re not meant to impress or gain approval. Spending motivated by a desire to give joy (like a surprise gift you know a friend wants but won’t buy for herself) or offer relief (a bag of groceries for a neighbor who’s strapped) is going to bring more fulfillment.

Kessel also notes that new habits are more likely to stick if they’re accompanied by a positive feeling. So, when you donate $200 to the victims of a recent hurricane (or to a food pantry or homeless shelter) instead of buying new boots, connect with that warm feeling of generosity. Bask in it.

“That,” he says, “is what’s going to generate your desire to do it the next time. It’s the same as when you buy a great new pair of shoes and get a dopamine rush. That warm feeling from being generous is going to make you want to do it again and again.”

3. Let Your Values Be Your Guide

When we stop buying things to keep up with the Joneses, or to keep up with the reward-seeking part of our brains, we can make more-conscious choices about our spending. This allows us to start using our money in ways that align with our values, which is where we really hit pay dirt.

This isn’t as abstract as it sounds. Animal lovers might gladly spend a little more on eggs from chickens raised in sunny yards instead of cramped, dark pens. Someone who cares deeply about kids may seek out clothing made by well-paid adults instead of exploited children. A small-business owner could commit to supporting other small businesses instead of big-box stores.

Begin this process by defining your values. Northrup recommends the following approach:

• Make a list of what matters most to you. It might include child welfare, fair wages, environmental stewardship, or animal rights. Then do some research on your favorite companies. You may discover they share your core values, which will reinforce your choice to support them. But if some are conducting their business in ways you don’t respect, you can choose to redirect your money to something better. And if you let a company know why it lost your business, you’re giving it the best possible motive to change its ways.

• Review recent credit-card and bank statements to determine which purchases aligned with your values. “Then you can measure it,” Northrup says. “Were 50 percent of your purchases in alignment? That’s good, but next time you’ll be more conscious of the decisions you’re making, and that number will go even higher.”

Making conscious, values-based decisions about who we support with our money can stabilize our own financial situations, Northrup says. “When you stop spending money on things you don’t value, you stop having buyer’s remorse.”

And when we begin to break down spending purchase by purchase, company by company, we discover our true spending power, Northrup says.

“I really do believe that our spending can become a kind of prayer for what we want in the world,” she says. “If we put our dollars toward things — and I’m not just talking about donations, but about supporting companies that support our values — that’s how we’ll change the world. What makes companies change is dollars.”

This Post Has 0 Comments